The U.S. dollar was broadly lower against its major counterparts on Monday, as hopes that the U.S. lawmakers would pass a deal to raise the country’s debt ceiling were tempered by concerns that the U.S. sovereign rating could still be downgraded.

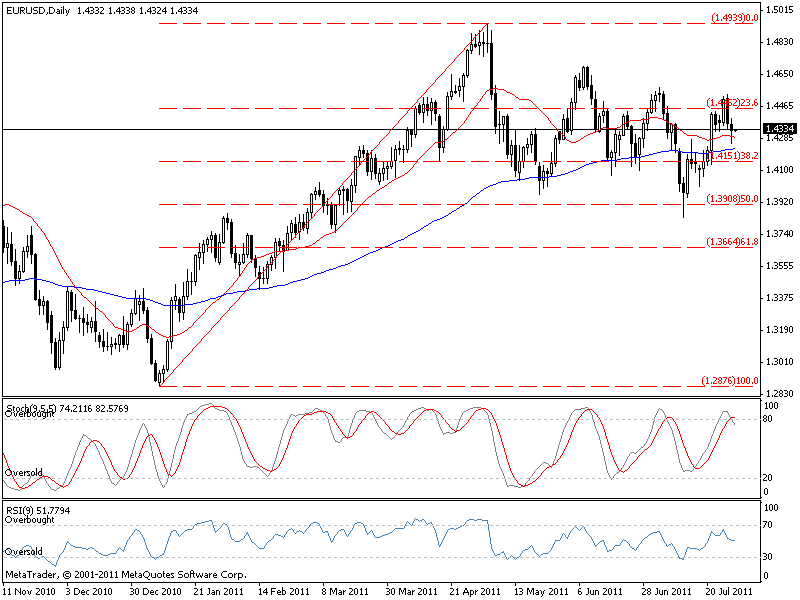

During European afternoon trade, the greenback was lower against the euro, with EUR/USD rising 0.19% to hit 1.4424.

President Barack Obama and Senate leaders announced Sunday night that they had reached agreement on a framework deal that will cut spending and increase the USD14.3 trillion federal debt ceiling, in order to avert a U.S. default.

But the greenback was higher against the pound, with GBP/USD slipping 0.11% to hit 1.6406.

Earlier in the day, a report showed that manufacturing activity in the U.K. declined more-than-expected in July, the first time it has been below the 50-level that separates contraction from expansion since July 2009.

Meanwhile, the greenback was up against the yen but touched a fresh record low against the Swiss franc, with USD/JPY rising 0.22% to hit 76.92 and USD/CHF shedding 0.28% to hit 0.7834.

In addition, the greenback was lower against its Canadian, Australian and New Zealand counterparts, with USD/CAD shedding 0.48% to hit 0.9508, AUD/USD rising 0.50% to hit 1.1049 and NZD/USD climbing 0.25% to hit 0.8814.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, slipped 0.24% to hit 73.81.

Later in the day, the U.S. Institute of Supply Management was to publish data on manufacturing activity.

Fill The Following

Free trials Form for Accurate Forex News .