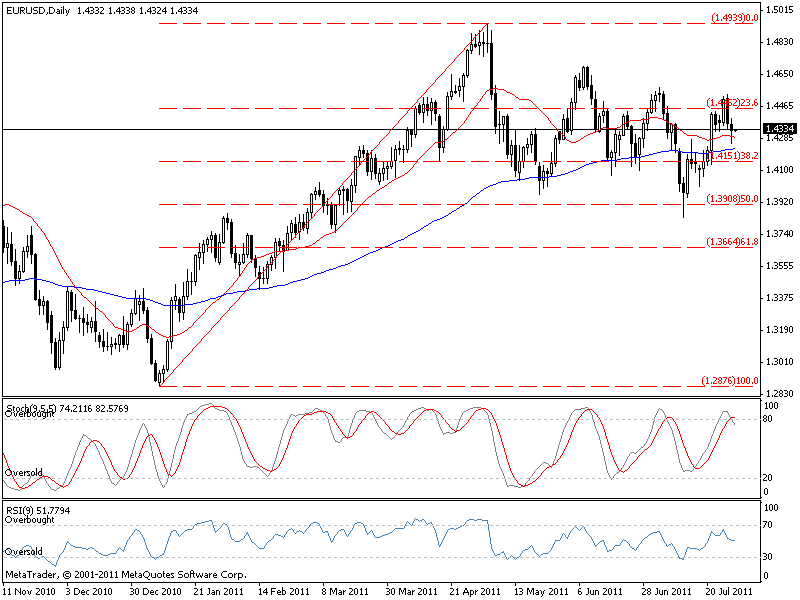

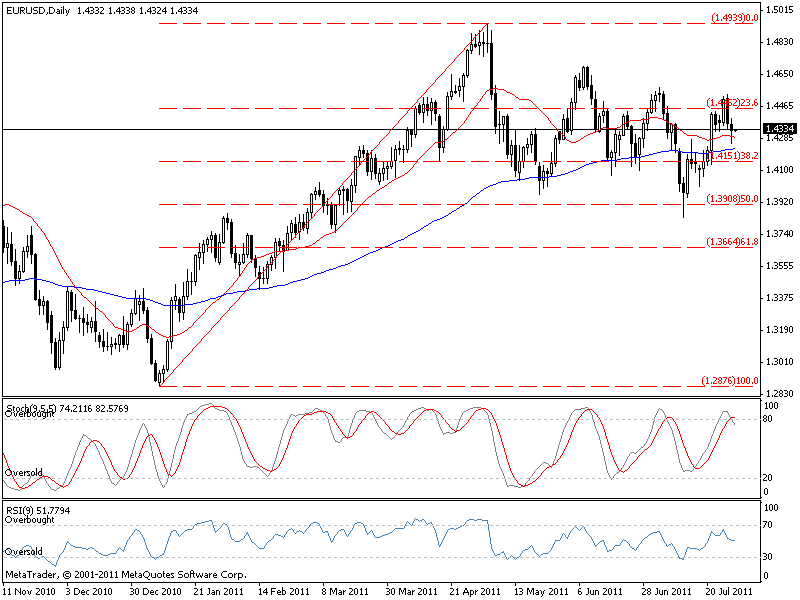

| Support | 1.3900 | 1.3665 | 1.3350 |

| Resistance | 1.4575 | 1.4695 | 1.4940 |

| Support | 1.3900 | 1.3665 | 1.3350 |

| Resistance | 1.4575 | 1.4695 | 1.4940 |

The rupee climbed to its highest level in 34 months on Wednesday as the dollar fell overseas and strong Asian peers supported.

* At 10:05 a.m., the partially convertible rupee was at 43.9400/9475 per dollar, after touching 43.90, its highest since Sept. 10, 2008.

* The dollar touched a fresh four-month low against the yen on Wednesday as the U.S. currency came under broad pressure after the Australian dollar surged on data showing that Australian consumer inflation rose faster than expected in the second quarter.

* The index of the dollar against six major currencies was at 73.482 points, below 73.650 points when the rupee closed on Tuesday. The euro was trading at $1.4513, compared to $1.4480 previously.

Free Forex tips for tomorrow 28th july , free forex news 28th july , free forex updates 28th july , free forex report , Forex calls for today 28th july